New Home Financing

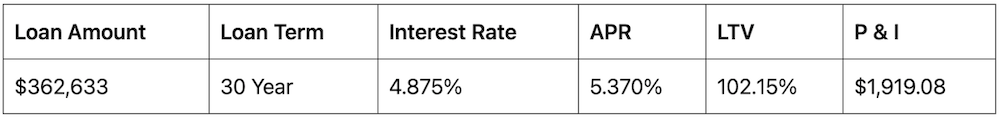

THE PRINCIPAL AND INTEREST PAYMENT ON A $362,633 30-YEAR FIXED-RATE LOAN AT 4.875% AND 102.15% LOAN-TO-VALUE (LTV) IS $1,919.08. THE ANNUAL PERCENTAGE RATE (APR) IS 5.370% WITH ESTIMATED FINANCE CHARGE OF $10,669*. THE PRINCIPAL AND INTEREST PAYMENTS, WHICH WILL CONTINUE FOR 360 MONTHS UNTIL PAID IN FULL, DO NOT INCLUDE TAXES AND HOME INSURANCE PREMIUMS, WHICH WILL RESULT IN A HIGHER ACTUAL MONTHLY PAYMENT. RATES CURRENT AS OF 2/1/2024. SUBJECT TO BORROWER APPROVAL.

*estimated finance charge paid by seller/builder with use of preferred lender edge home finance NMLS 891464*

Our preferred lender offers tailored financial solutions based on their deep understanding of the real estate market. With a streamlined approval process, you can enjoy faster and hassle-free financing. Plus, you may be eligible for lower interest rates and more favorable loan terms, resulting in significant savings! Choose our preferred lender for an easier, more affordable, and less stressful home buying experience.